Information on the campus budget planning process: Supporting campus units with the development of annual operating budgets

Planning Assumptions and Parameters

Information and resources on budget planning efforts.

- Budget Model Allocations

- Core Funding Ongoing Allocations

- Salary and Benefits

- Overhead Assessments

- Aggie Budget Global Planning Assumptions

2024-25 Planning Communications

- 2024-25 Faculty Recruitment Planning - April 18, 2024

- 2024-25 Budget Framework Letter - April 3, 2024

- 2024-25 Preliminary Budget Framework Letter - February 20, 2024

2023–24 Planning Communications

- 2023-24 Budget Status and Allocations - June 29, 2023

- 2023-24 Faculty Recruitment Authorization - June 28, 2023

- 2023-24 Faculty Recruitment Planning - March 14, 2023

- 2023-24 Budget Framework Letter - March 9, 2023

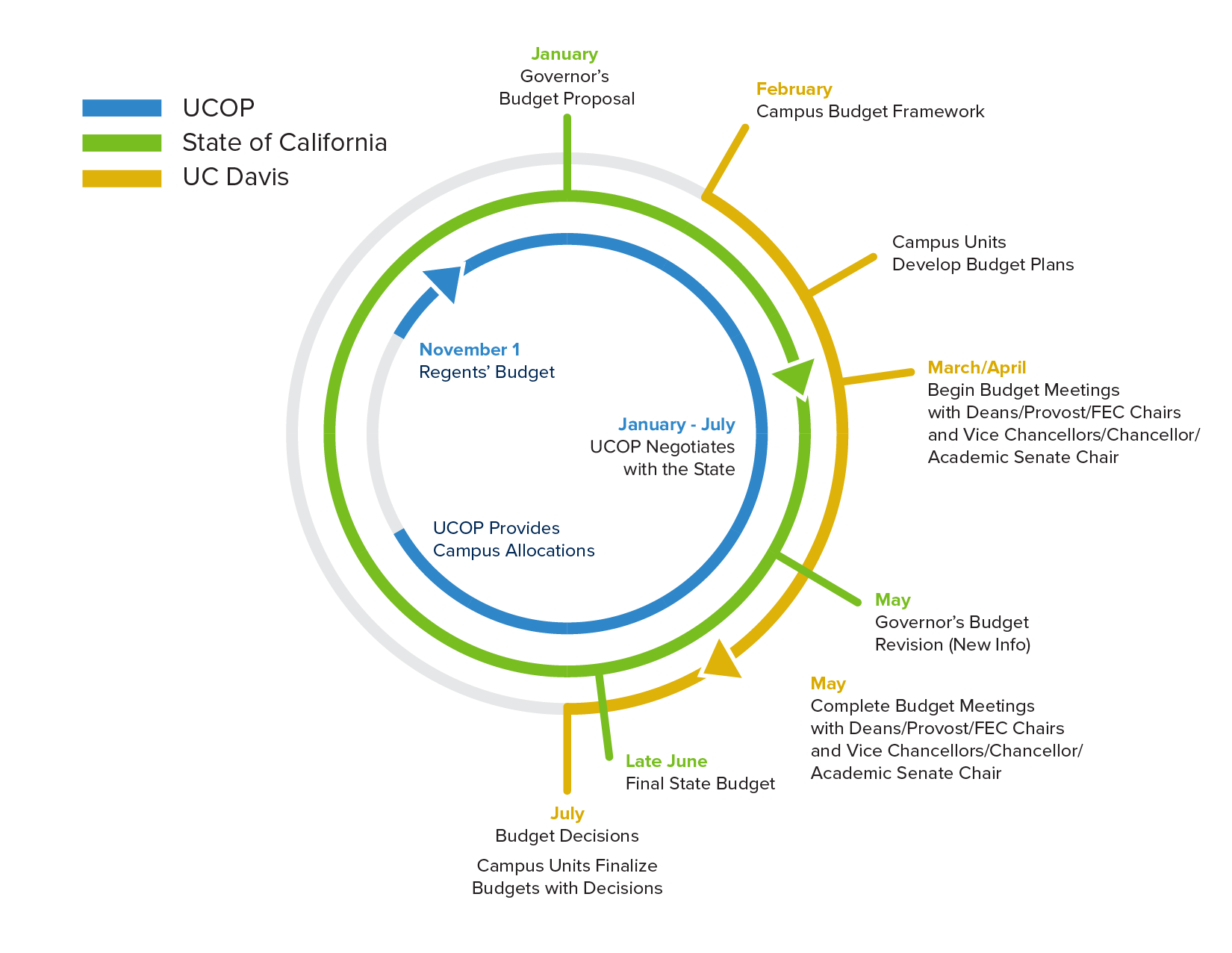

Budget Planning Cycle

The Campus Budget Cycle activities are tied to the budget processes of the UC Regents and State of California. Funding to support UC Davis’ core instructional mission is largely derived from tuition and fees paid by students, which are set by the Regents, and allocations from the state. The graphic below depicts how these three decision processes build on one another to culminate in the campus budget.

![]() Download Graphic (PDF)

Download Graphic (PDF)